How B2B Sales Teams Should Adapt For Digital Transformation [Report]

ONBOARDING TO DIGITAL

How B2B Sales Teams Improve Customer Relationships in Connected Environments

INTRODUCTION

As B2B customers adopt digital interfaces to conduct business, relationships forged by salespeople must graduate to new digital environments.

But companies are concerned they will lose customers when deals conducted online become purely transactional—customers that find a cheaper deal elsewhere may not hesitate to move on. The personal relationships salespeople form with customers become all the more important as they open up the possibility of negotiations and ultimately retention.

Today, some sales and eCommerce teams have minimal involvement. Sales teams have their own set of strategies to carry out, while eCommerce teams have their own plans for development. In these cases, eCommerce is used as a promotional platform for products while sales teams have their own priorities, roadmap, and operations.

In other cases, sales teams’ involvement with eCommerce solutions is paramount. Sales teams have the customer insights required to develop engaging eCommerce solutions—ones that both satisfy customers and drive retention. Their expertise helps turn eCommerce into a sales tool on which the company can depend.

Many in the industry predict a self-service selling model will become a new transitional step. Companies are wondering: will personal relationships remain important throughout the customer journey, or will they fade off once the customer moves onto a digital platform?

In this study, we analyze industry pain points and directly consult B2B sales leaders to understand how they are approaching their digital transformations. Then, we uncover how the direct attention of salespeople will remain relevant in a complex, technology-driven sales environment.

ABOUT the STUDY

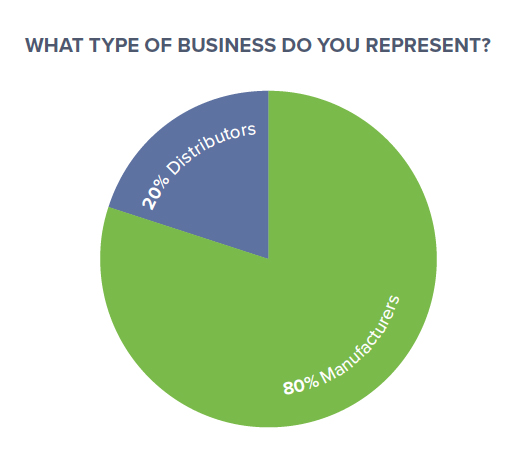

Insite Software partnered with WBR Insights to survey 100 members of B2B sales leadership across the United States and Canada. The study focuses on the evolving role of salespeople throughout companies’ digital transformations. The results demonstrate how digital sales success among manufacturers and distributors is directly tied to sales teams’ commitment to established digital initiatives.

The majority of respondents to the study (80%) represent manufacturers, while the remaining 20% represent distributors.

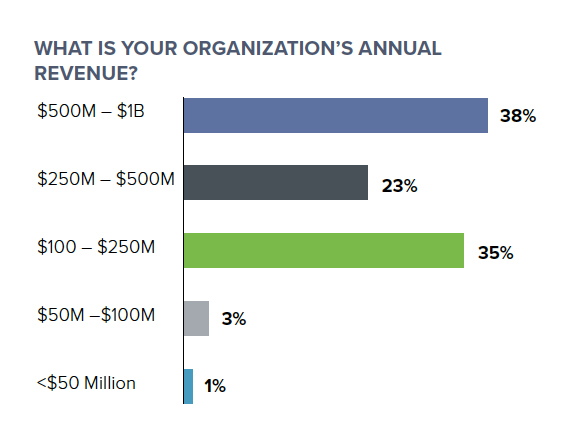

The vast majority of B2B companies represented (96%) have annual revenues of $100 million or more. Most companies (61%) make between $250 million and $1 billion in annual revenue, where 38% of all respondents make between $500 million and $1 billion. Only 4% of companies in the study make below $100 million in annual revenue.

The study features key quotes from B2B sales leaders across verticals, all of whom are respondents to the survey themselves and agreed to be quoted directly in the report.

“Personal relationships are important throughout the life of the business. The relevance or importance of these relationships doesn’t change in the digital environment; the only thing that changes is the channel through which they are operated.”

ED STRENK, VICE PRESIDENT, SALES EXCELLENCE AT AXCELIS TECHNOLOGIES, INC.

EMPOWERING SALES TEAMS through DIGITAL CHANNELS

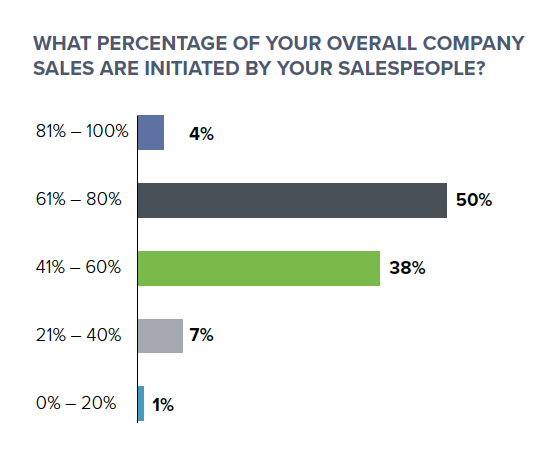

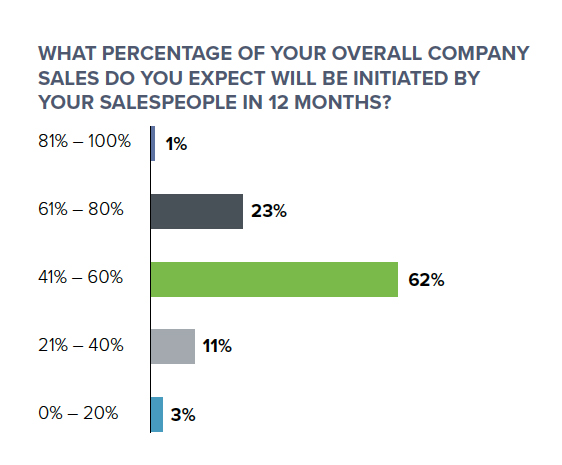

In 12 months, 30% fewer companies will have 61% or more of their sales initiated by salespeople than at present.

The use of eCommerce in B2B sales has increased over the last decade, forcing companies to consider the pros and cons of driving new sales initiatives using digital solutions. As we will find, most sales and eCommerce teams have been integrated to improve coordination. This gives both teams an opportunity to develop a better platform and work alongside each other in terms of strategy.

Currently, the majority of companies claim their salespeople initiate at least 61% of their sales. However, the vast majority of companies expect salespeople will initiate fewer than 61% of sales in 12 months.

Most companies currently receive from 61% to 100% of their sales from salespeople, where 50% of companies receive from 61% to 80%. Comparatively, only 23% of companies expect 61% to 80% of their sales to come from salespeople in 12 months—less than half as many as at present.

In terms of sales development in 2018, over half of companies (55%) claim investing in the performance of their digital channels is their priority. Conversely, 45% of companies claim investing in the performance of their salespeople their priority.

But the roles of sales teams are increasingly involved in sales via these digital channels, and salespeople continue to lead in terms of sales performance. Respondents claim that salespeople are well equipped, informed, and available to customers, which makes them their most valuable sales channel. As we will find, empowering salespeople with digital tools and integrating them with core technologies is a top priority for most companies. This includes compensating sales teams for sales carried out via digital channels.

“The involvement of the sales team is comparably more than any other department of the business. eCommerce solutions have been introduced to assist the sales sector of the business. Sales are not restricted to transactions only and have different levels associated…. eCommerce solutions have been introduced to manage these levels.”

BRADLEY ROLFE, VICE PRESIDENT SALES & MARKETING AT BRILLION IRON WORKS

Respondents shared details about their preferences in terms of digital or person-to-person sales. Researchers found that a greater number of companies are most successful with person-to-person sales (36%) than those most successful with digital sales channels (28%).

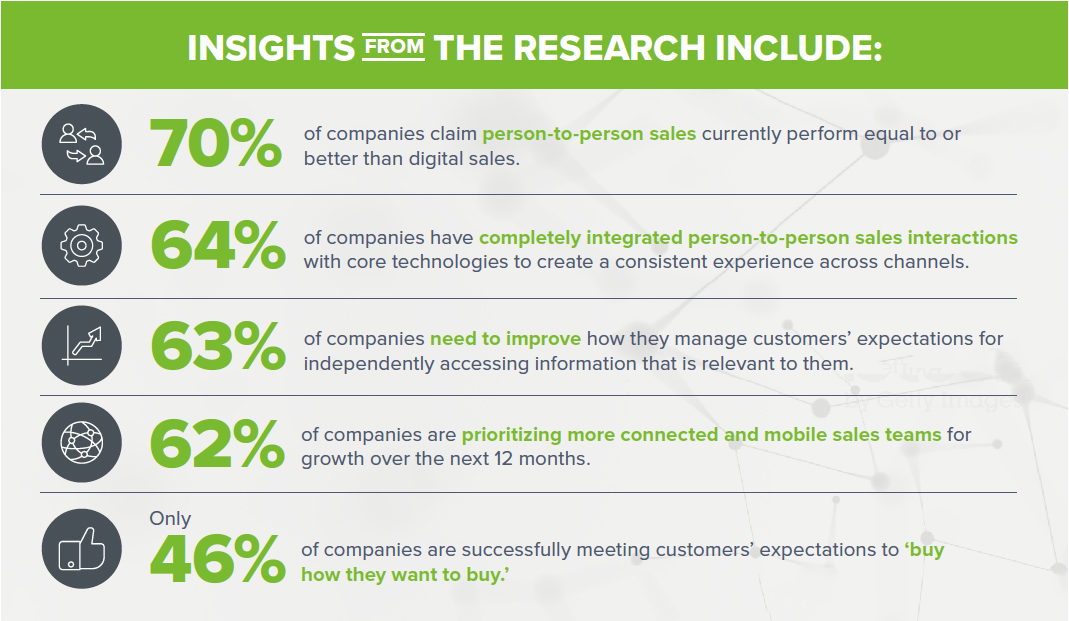

However, there is overlap in how the majority of companies stand. The greatest majority of companies (70%) claim person-to-person sales perform equal to or better than digital sales. Meanwhile, an overlapping majority (62%) claim digital sales channels perform equal to or better than person-to-person sales.

Within those majorities, 34% of companies claim their digital and person-to-person sales perform mutually well. Although person-to-person sales lead in performance, the share of companies that favor these sales, digital sales, or both aren’t far apart in number. And while a plurality favors person-to-person sales, the median lies with those who favor the two channels equally.

Researchers looked at the two sales categories in more detail to find that the salesperson’s role increasingly overlaps with digital initiatives. In fact, 60% of companies compensate their salespeople for their online sales.

For most companies, salespeople are the representatives of their businesses, even as they gradually become involved with digital solutions. As we will find, sales teams that are modernized and well versed with connected and digital technologies can meet the dynamic demands of buyers, personalizing experiences across channels.

That’s why some companies are training sales teams on multiple sales channels. Their performance is measured by their ability to carry out deals through both digital and person-to-person channels as a result.

“In our business, the sales team and eCommerce are the same…. A new eCommerce site replaces the cumbersome traditional order entry model, where the sales team captures the order from the customer and then gets these entered into the ERP system. This was typically done by talking with the CSR team on the telephone or entering them manually while sitting in the office. Now, it can be done directly while talking to the customer.”

ROCKY LITTLE, HEAD OF SALES AT BEARING DISTRIBUTORS, INC.

In this way, digital channels have become complementary to the efforts of salespeople—adding new dimensions for customer interactions rather than detracting from them. Several companies report that sales teams have been instrumental in customizing and

developing their eCommerce solutions. They’ve found they are best suited for determining their requirements, features, and other fringe aspects of eCommerce solutions because of their foundational knowledge of customer needs.

INTEGRATING CUSTOMER TOUCHPOINTS to MEET EVOLVING EXPECTATIONS

The digital sales environment is also providing new solutions for managing customer relationships that have been forged over the years by salespeople. These personal relationships are foundational for most B2B companies. Customers may be inclined to choose certain brands and products over others because of the relationships they have with their sales teams. Now, companies are trying to avoid distorting these existing relationships and instead improve upon them by using the benefits of new technologies.

In the case of one company, half of its sales team has been transformed to manage and curate eCommerce solutions. Their customers prefer eCommerce because of its accessibility and enjoy a superior experience thanks to the contributions of the sales team.

“The digital environment is pushing sales in a different direction and making it more of a virtual activity. Most of the sectors have already undergone this change, whereas our business is slowly moving towards this change. As the change takes place, we have to be extra cautious with the relationships that have been maintained, but they should also be onboarded carefully.”

JODY KEMP, DIRECTOR OF SALES CORPORATE AT ALLIED ELECTRONICS

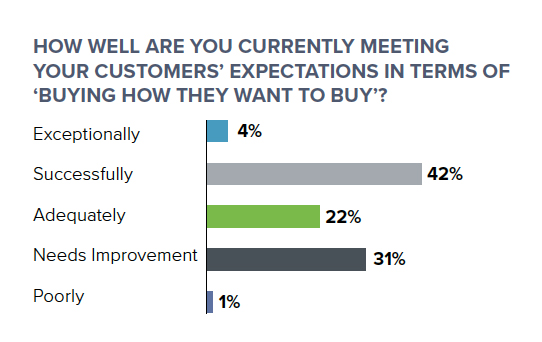

Nonetheless, most B2B companies remain less than confident in how well they meet their customers’ expectations in terms of ‘buying how they want to buy.’

Less than half of companies (46%) are meeting these customer expectations successfully or exceptionally. About one-third (32%) claim that they either need to improve how they meet customer expectations to ‘buy how they want to buy’ or that they are doing so poorly. Twenty-two percent are meeting customers’ expectations only adequately.

This leaves substantial room for improvement for the majority of companies, many of which are hung up on how to optimize their eCommerce solutions for B2B sales. For many companies, eCommerce platforms can’t handle the dynamism of their complex products, which sales teams are more adept at managing and demonstrating to customers.

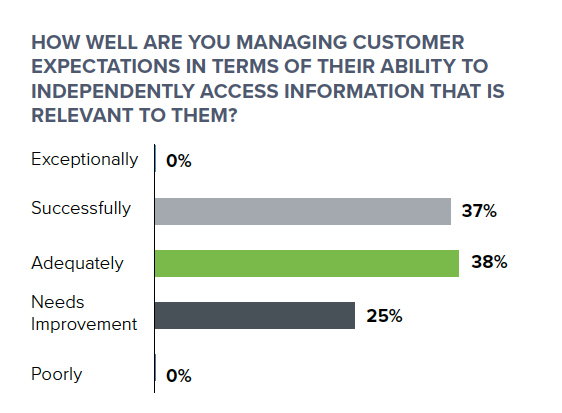

However, B2B companies face a converse problem in how they supply self-service options for customers. While in many cases sales and eCommerce teams work hand in hand, many companies fail to provide customers with their own points of access to critical information without the assistance of a representative. Companies that leverage eCommerce systems as a tool for sales teams may overlook the potential exclusivity of eCommerce and other digital platforms as self-service models for customers.

As a result, most B2B companies are not very confident in how well they are managing customer expectations in terms of their ability to independently access information that is relevant to them. Thirty-eight percent claim they are doing so only adequately, while one-quarter of companies claim they need to improve. Only 37% believe they are managing customer expectations in this way successfully.

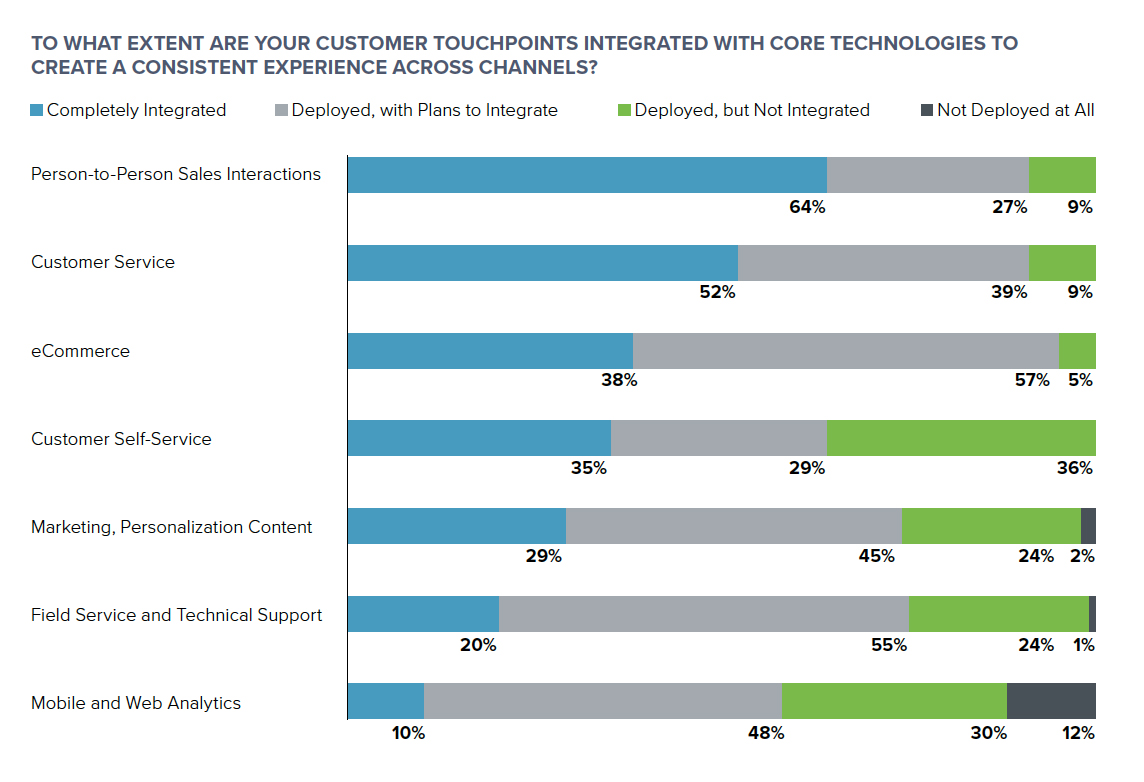

Still, most B2B companies (64%) have either integrated or are planning to integrate customer self-service with core technologies to create a consistent experience across channels.

Respondents were asked to what extent they’ve integrated seven customer touchpoints with core technologies to create a consistent experience across channels. In this case, 35% of companies have completely integrated customer self-service, while 29% have deployed customer self-service with plans to integrate with core technologies.

Meanwhile, 36% of companies have deployed customer self-service without integrating them with core technologies—the most companies to do so among the seven customer touchpoints measured in the study. Nonetheless, a significant number of companies plan to improve self-service options for customers over the next 12 months.

36% of companies have deployed self-service options without integrating them with core technologies, but 42% are prioritizing improvement of self- service options in the next 12 months.

Meanwhile, companies have prioritized fully connecting salespeople to core technologies to create a consistent experience across channels—more so than digital technologies like eCommerce, customer self-service, marketing personalization or content, field service or technical support, and mobile or web analytics. In fact, the majority of companies (64%) have already completely integrated person-to-person sales interactions with core technologies to create a consistent experience across channels.

But the data shows that eCommerce is set to be the most integrated customer touchpoint in the study. Every company in the study has deployed an eCommerce solution. Thirty-eight percent have completely integrated eCommerce with core technologies for this purpose, and 57% have deployed eCommerce with plans to integrate. Only 5% have deployed eCommerce with no current plans to integrate.

“To keep the sales procedure integrated, we decided to merge both the teams and give them collective, realistic targets. So now, eCommerce and sales both follow the same strategies.”

JEFF BADOLATO, SALES OPERATIONS MANAGER AT IMPERIAL DISTRIBUTORS

Sales teams that work hand in hand with eCommerce teams provide solutions and also help them with supply, marketing, advertising, and also customer service. Most companies (52%) have completely integrated customer service—including call center, online chat, customer portals, and others—with core technologies as well.

Just over one-quarter of companies (29%) have completely integrated marketing, personalization, and content with core technologies, while 45% of companies are planning to integrate. One respondent observes that even in a digital environment, customers look for the personalized experiences they’ve enjoyed through their lasting relationships with salespeople.

While eCommerce serves as a supplementary tool to some salespeople, B2B companies are learning they must invest in standalone digital solutions that contribute not only to sales relationships but holistic service to customers.

Most companies (55%) have deployed field service and technical support, but are still in the planning stages in terms of integrating them with core technologies for a consistent customer experience across touchpoints.

Only 20% have fully integrated field service and technical support. This will soon become a critical aspect of service as customers expect technicians to be knowledgeable about both products and customers’ data and preferences.

The data shows that companies have aligned their business to digital sales models and sales connectivity versus other engagement models like customer self- service, field service and technical support, and mobile and web analytics, the latter of which only 10% of companies have integrated with core technologies.

That’s why companies plan to invest more in connectivity for sales teams who can leverage critical digital resources as needed. They will personalize sales interactions through multiple touchpoints, both digital and interpersonal. Finally, they will improve customer service experiences, both through cross- channel access to service representatives and modernized field service and technical support.

“In our business scenario, we have institutional customers with whom we have developed personal relationships over the years. We have worked hard to maintain these relationships. The existence or introduction of digitization has not hampered these relationships but has helped us strengthen them by helping them develop, too, on the digital platform.”

JIM PETTIT, VICE PRESIDENT OF SALES AT BRADY CORPORATION

A HOLISTIC APPROACH to DIGITAL TRANSFORMATION

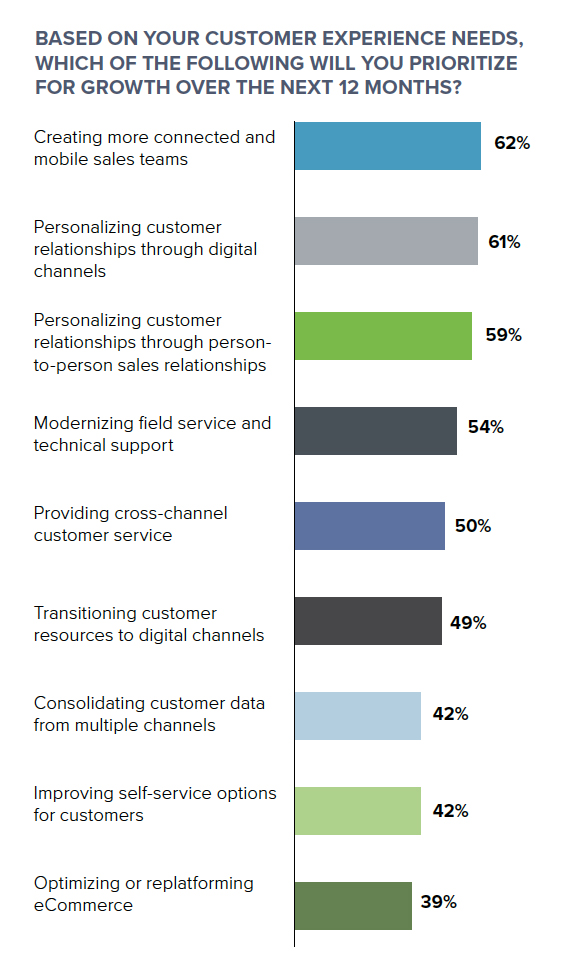

Empowering sales teams through mobile connectivity and personalizing their customer relationships are priorities over the next 12 months, and that personalization will extend to digital channels.

B2B companies will not forfeit the critical roles salespeople play in building relationships that drive both sales and loyalty. Salespeople are equipped to educate customers about the products and policies of the organization. With good training and performance, they will continue to drive profits in these ways.

The research shows that companies will continue to prioritize investments in sales teams to meet their customer experience needs over the next 12 months, albeit with the addition of key digital initiatives. In addition to creating more connected and mobile sales teams, a majority of companies are prioritizing personalization that spans personal and digital interactions, as well as customer engagement models outside of direct sales environments.

In fact, between 39% and 62% prioritize each of the nine initiatives in question, where four of the initiatives are prioritized by a majority of B2B companies.

Sixty-two percent of companies are prioritizing creating more connected and mobile sales teams, giving them more immediate access to resources. Salespeople will have more flexibility thanks to streamlined digital processes and greater opportunities to drive personalized experiences for customers.

In fact, a majority of companies are prioritizing personalization through digital channels (61%) and through person-to-person sales relationships (59%) to an almost equal degree. Companies who achieve seamless personalization between person-to-person and digital environments are most likely to avoid disruptions in existing and new relationships with customers, with greater opportunities for loyalty.

Companies acknowledge they need a holistic approach to the customer experience. They’re investing in better service channels to meet their customer experience needs over the next 12 months: a majority of companies (54%) are prioritizing modernizing field service and technical support for gth, and half of companies (50%) are prioritizing cross-channel customer service for gth.

Almost half of companies (49%) are prioritizing transitioning customer resources to digital channels in the next 12 months — a substantial number considering this important and potentially disruptive change. As stated, 38% claim they are only adequately managing customer expectations in terms of their access to information that is relevant to them, while 25% of companies claim they need to improve.

Similarly, 42% of companies prioritize improving self- service options for customers. Most B2B companies (64%) have either integrated or are planning to integrate customer self-service with core technologies to create a consistent experience across channels.

Finally, 42% of companies have made consolidating customer data from multiple channels a priority over the next 12 months, and 39% of companies plan to optimize or replatform their eCommerce solutions, suggesting most companies are satisfied with their existing eCommerce platforms.

Companies’ plans indicate their need to take a holistic approach to digital transformation. This now involves more than the sales environment alone. Companies must transform the ways they engage and empower customers with better digital solutions and greater connectivity between touchpoints to realize long-term success.

CONCLUSION

Personal sales relationships are the product of salespeople’s hard work, from which sales themselves will follow. This is how salespeople have interacted with customers and assisted them in choosing one brand over another for years. Businesses are built on these relationships. Now they must maneuver customers towards the digital side of business so that these relationships can continue with a new set of advantages.

But integrated digital and person-to-person sales are only one segment of customers’ evolving expectations. To quote one respondent, “The digital environment is a vast business universe” that extends to customer

service, field service, and self service, all of which need to be modernized and integrated to provide complete and holistic experiences. In this way, the relationships and expectations orchestrated by sales teams can be sustained across all customer touchpoints.

The greater companies’ success in integrating these touchpoints with core technologies, the more they will drive loyalty from their long-standing customers, and the more they will acquire and retain entirely new ones.

ABOUT the AUTHORS

Insite SoftwareTM is the leading provider of powerful digital commerce solutions architected for manufacturers and distributors. The InsiteCommerce® Suite of products goes beyond commerce to connect people, products and channels for a rich, omnichannel experience. Insite believes eCommerce is more than a website. It’s about transforming your business and delivering a best-in-class experience for your customers, partners and sales team across the organization. With more fully-supported, native, B2B capabilities out-of-the-box than any other platform in the marketplace. Insite delivers digital commerce without compromise. Learn more at: www.insitesoft.com

B2B Online is the premiere, annual, interactive event for digital and eCommerce executives within the industry. B2B Online will give you the tools to address key issues you face including, the multigenerational workforce, digital marketplaces, globalization and localization, tracking ROI on eCommerce investments, customer experience, omnichannel integration, content management, and mobile and social.

We are a team of writers, researchers, and marketers who are passionate about creating exceptional custom content. WBR Insights connects solution providers to their targeted communities through custom research reports, engaged webinars, and other marketing solutions. Learn more at: www.wbrinsights.com