Channels For The Next Generation of B2B Purchasing [Survey Report]

The Next Generation of B2B Purchasing Channels:

Millennials, Marketplaces and Digital Channel Purchasing Preferences

How age groups and evolving puchasing channel adoption are redefining B2B sales

Introduction

B2B salespeople continue to use traditional methods of selling, such as engaging buyers via phone calls or even face to face. But time has become a constraint for buyers, and new digital purchasing channels have emerged to speed up the buying process. In this report, we explore the B2B buyer demand for those digital channels versus traditional channels.

Buyers acknowledge the “amazing experiences” sellers can provide using digital platforms, which provide greater availability of more products, easier management of operations and relationships, and successful on-time product delivery. Digital channels, including marketplaces, have emerged as the clear, transformative favorites among the youngest buyers in the workforce—Millennials, born from 1977 to 1995—and as a popular choice among other age groups as well.

“Organizations like Amazon have created an efficient strategy where they have built their organization around the customer. Most build their organization around a product.”

Brian Carlson, Director, Indirect Sourcing & Procurement at Target Corporation

“Sellers need to upgrade digitally as per the situation in the market. The market has become hyper demanding and the seller needs to increase their profitability to remain competitive... Digitization is the best way they can achieve it.”

Pizarro Olivos, Manager, Procurement & Business Administration at Hipermercados Jumbo

Table of Contents

- Introduction

- About the Study

- Segmentation by Age Group

- The Gap Between B2B Buyer Needs and Sales Experiences

- Recognizing Buyer Experience Needs in Digital Channels

- Differences in Channel Preferences by Age

- Recognizing Buyer Experience Needs in Digital Channels

- Age Groups Prioritize Needs and Digital Benefits

- B2B Digital Purchasing Summary by Age Group

- Summary

- Conclusion

- Appendix

Now, a majority of buyers in all age groups are prioritizing digital channels for greater flexibility and personalization, as well as capabilities that help them manage the full life cycle of the buying process. This includes marketplaces, which facilitate their own transparent, all-access ecommerce sales and services. This digital paradigm is a stark contrast to the one-on-one, negotiated terms found in traditional B2B sales. As buyers increasingly demand more options, pricing transparency, and greater flexibility, B2B sellers are transitioning online.

The urgency for this model is clear given the evolving habits of a new generation of buyers. In their World Online Population Forecast, 2017 to 2022 (Global),1 Forrester reports that by 2020, 46% of adults will be Millennials. This age group approaches buying with different attitudes and priorities, driving B2B sellers to transform the way they engage with all customers. Favoring transparent, more competitive models over negotiations in one-to-one interactions, this growing population will soon dictate the terms by which B2B products are sold.

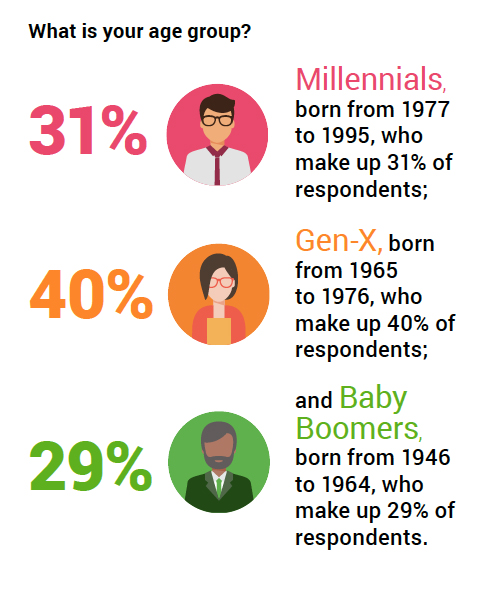

The preferences of seasoned professionals are changing in this new environment as well. Those buyers who have long preferred the RFP or tender process are now adopting digital environments at a universal scale. The Baby Boomer age group—born from 1946 to 1964—and Gen-X age group—born from 1965

to 1976—have unique preferences emerging from their use of digital environments as well.

Mirakl and Oracle partnered with the B2B Online research team to conduct a study of 200 global B2B buyers across verticals. We studied not only their behavior, but their differences in attitudes across three generations—Baby Boomers, Gen-X, and Millennials—and between those that prefer RFPs and those that do not.

Key insights include:

Millennials (31%) are the most likely to prefer marketplaces, more than either Gen-X (29%) or Baby Boomers (19%).

73% of buyers generally use digital channels. Most prioritize pre-ordering and back-ordering (72%), personalized product recommendations (65%), and scheduling (63%), among other benefits.

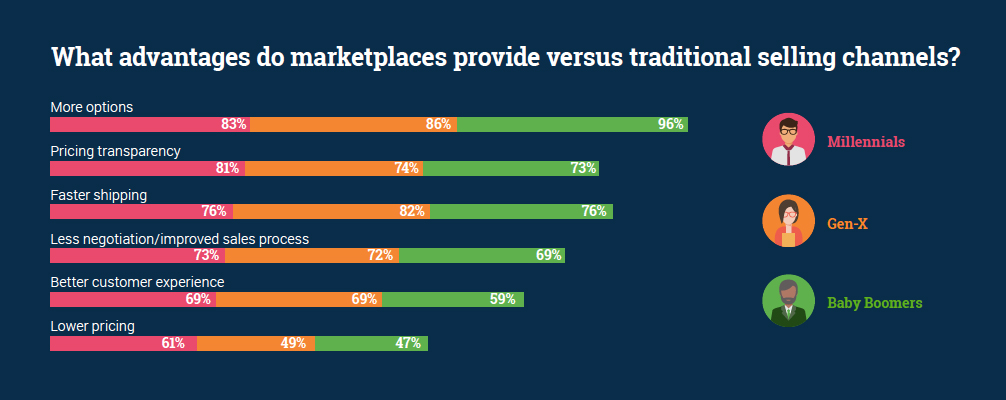

In each age group, approximately 70% of buyers value the fewer negotiations and improved sales processes associated with marketplaces.

About the Study

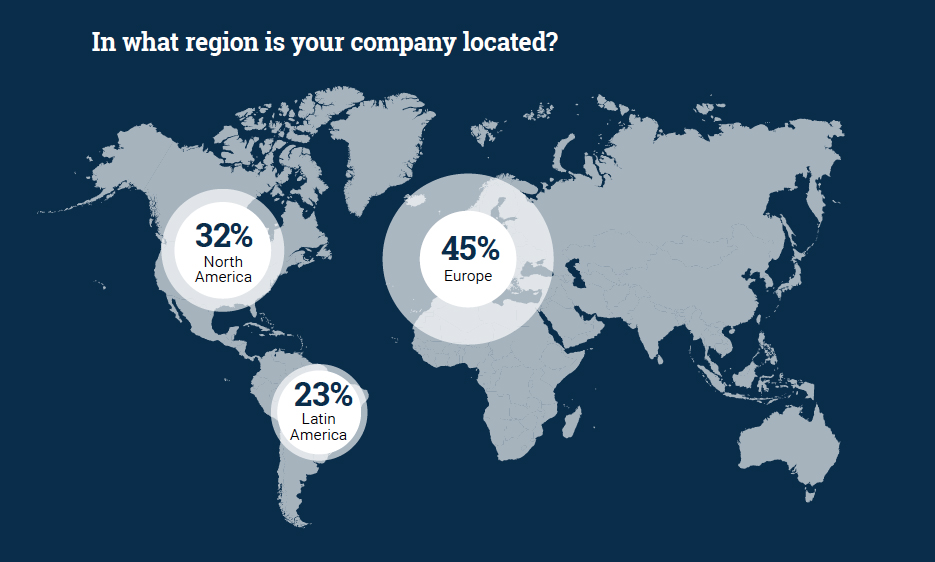

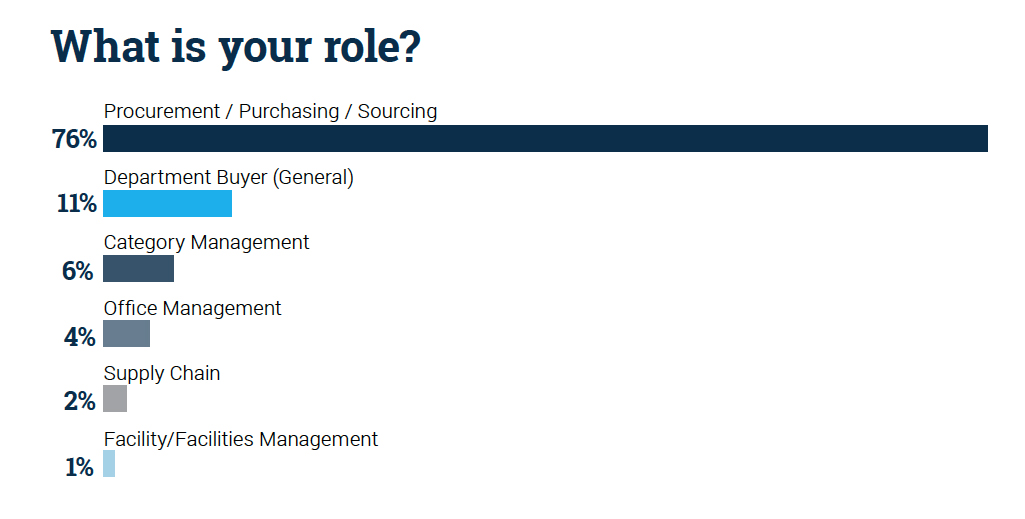

Mirakl, Oracle, and B2B Online surveyed 200 B2B buyers across Latin America, Europe, and North America. Respondents represent only private companies with more than $500 million in annual revenue. The majority of B2B buyers do business with both manufacturers (86%) and distributors (90%). Each respondent is directly involved in their company’s buying processes and represents one of the three age groups measured in the study.

Respondents represent companies from a wide range of industries. They bring their own unique perspectives from each B2B sales environment. The vast majority identify as procurement, purchasing, or sourcing professionals.

*See Appendix A for the complete data.

“With Amazon Business rapidly expanding into B2B distribution, food service distribution stands out as a likely target. Amazon has already invested heavily in the food and grocery category in B2C, and success in B2B food distribution is an equally large opportunity... Industry fragmentation will heavily favor its success.”

Ryan Curtis, North American Regional Lead Category Buyer – Strategic Procurement at Gordon Food Service

Segmentation by Age Group

The emphasis of this study is on buyer habits as they relate to generational preferences. The study focused on respondents across three different age groups:

Age groups now play a key role in how manufacturers and distributors engage buyers. Some respondents claim Millennials now make up the majority of their customer base. Those sellers using marketplaces are leveraging Millennials’ digital savvy and desire for a variety of options to earn their loyalty. In B2C sales, younger consumers turn to Amazon first when researching and buying products— something B2B sellers hope to recreate in their own sales environment.

But as we will find, digital transformation in B2B sales addresses broader appeal among buyers. Buyers entrenched in the RFP or tender process and those generally interested in more efficiency, better customer service, and a wider variety of products have found advantages using marketplaces as well.

The Gap Between B2B Buyer Needs and Sales Experiences

The B2B sales environment is growing more competitive as manufacturers and distributors struggle to provide buyers with the experiences they demand. Buyers want a mix of channels to purchase from. Those that start their searches online may choose to engage sellers through traditional channels, especially if those sellers are yet to provide their own digital channels.

The availability of both digital and person-to- person channels provides more opportunities for buyers. Those sellers that depend heavily on a single channel will lose opportunities to competitors.

The result is a gap between the existing experiences offered by some B2B sellers and buyers’ purchasing needs. Many suppliers are unaware of digital options available to them, thereby elongating the sales process or turning away buyers altogether. Our study shows that practically all buyers that prefer RFPs are turning to marketplaces. Millennials, soon to make up the bulk of the buying community, prefer marketplaces above other age groups as well.

“Ever since ecommerce giants emerged on the B2B competitive landscape...[the] majority of buyers are expected to make half or more of their work purchases online. This trend will likely grow as more purchasers find that procuring products and services from a website is more convenient than buying from a sales representative... It will take time for all suppliers to shift to the online sales channel, therefore creating a gap between the traditional B2B sellers and the modern buyers.”

Gavin Angell, Development Director at The Dorchester Group

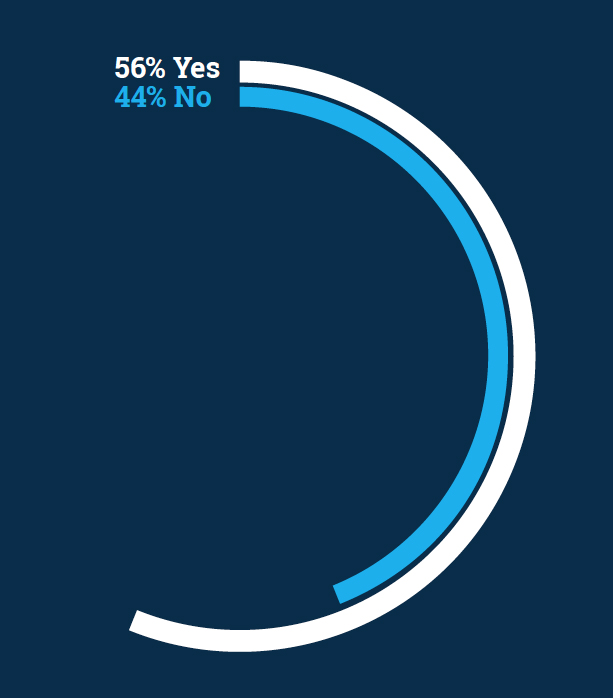

Do you feel there is a gap between the existing experiences offered by B2B sellers and your evolving needs for purchasing?

Most respondents (56%) feel there is a gap between the existing experiences offered by B2B sellers and their evolving needs for purchasing. Respondents identify greater needs for digitization and better ecommerce experiences as contributors to this gap. Buyers who acknowledge a gap cite a lack of flexibility in terms of minimal purchase orders, for example, where bulk orders aren’t always needed. Timely delivery across regions is a consistent problem as well. Sellers must adopt nuanced, more competitive solutions that support faster, flexible, and easier experiences for buyers.

Recognizing B2B Buyer Experience Needs Across Channels

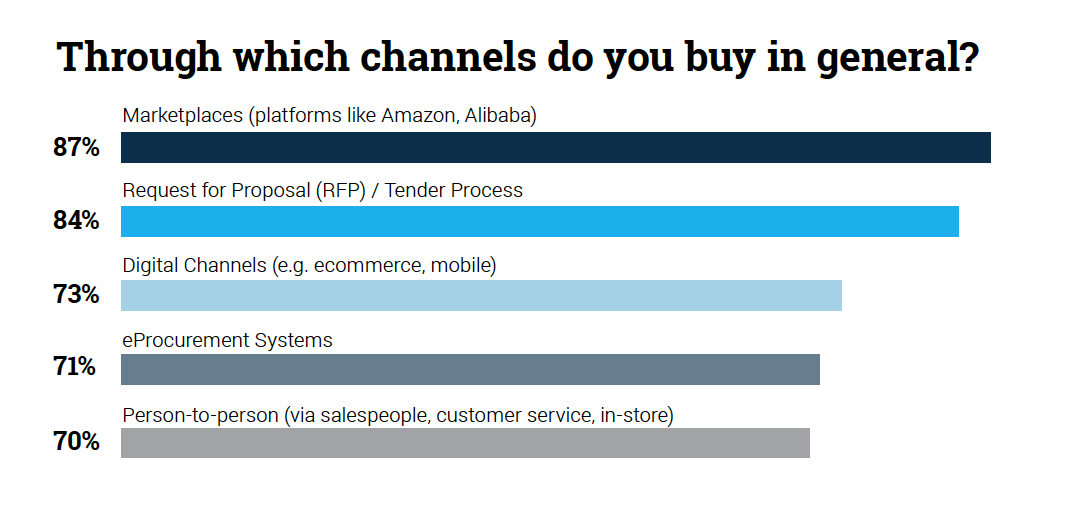

In each case, a majority of respondents generally buy through all five channels measured. As mentioned, the RFP or tender process remains the preferred channel; but 87% of respondents generally buy through marketplaces, making it the most widely used channel among all others.

When segmented by age group, the results show that Millennials drive this widespread adoption. As 97% of Millennials generally buy through marketplaces, they are 14% more likely to do so than Baby Boomers, and 16% more likely than Gen-X.

The RFP or tender process is nearly as popular among all respondents as marketplaces, with 84% of respondents buying through this channel in general. Just as Millennials drive up the general use of marketplaces among all buyers, Baby Boomers generally buy through the RFP or tender process more often than other age groups. 90% of Baby Boomers general buy through the RFP or tender process, making them 16% more likely than Millennials to do so, and 21% more likely than Gen-X.

“Our evolving needs for purchasing keep changing because the market is not very stable, and we deal in a number of regions which have their own demands for products... They control the purchasing strategy depending on the demand, leading to a number of risks in order to make abrupt changes.”

Claire Steenbrink, Senior Buyer – Packaging at L’Oréal S.A.

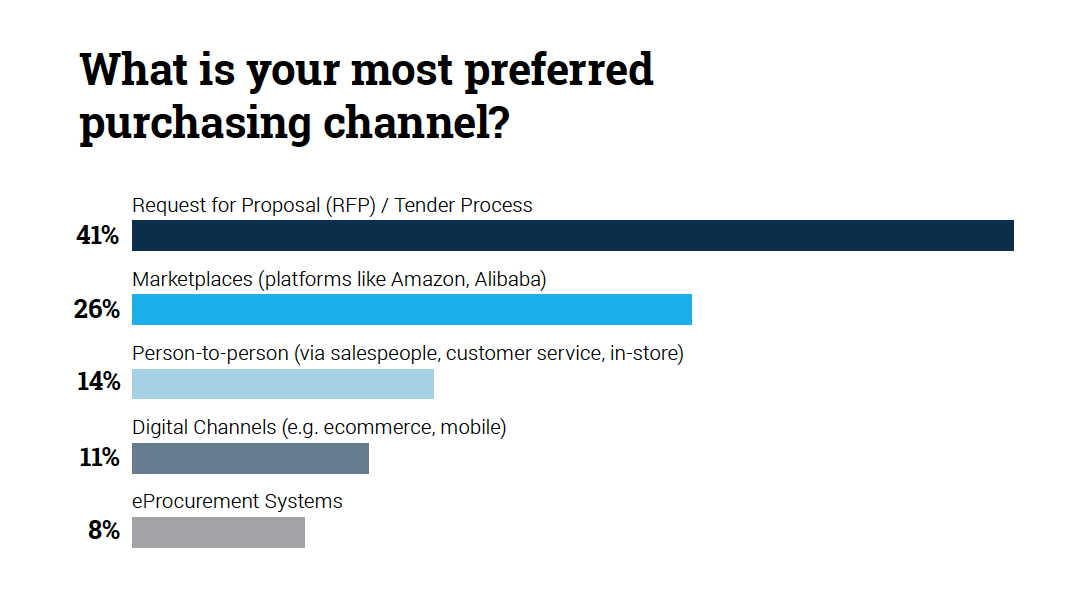

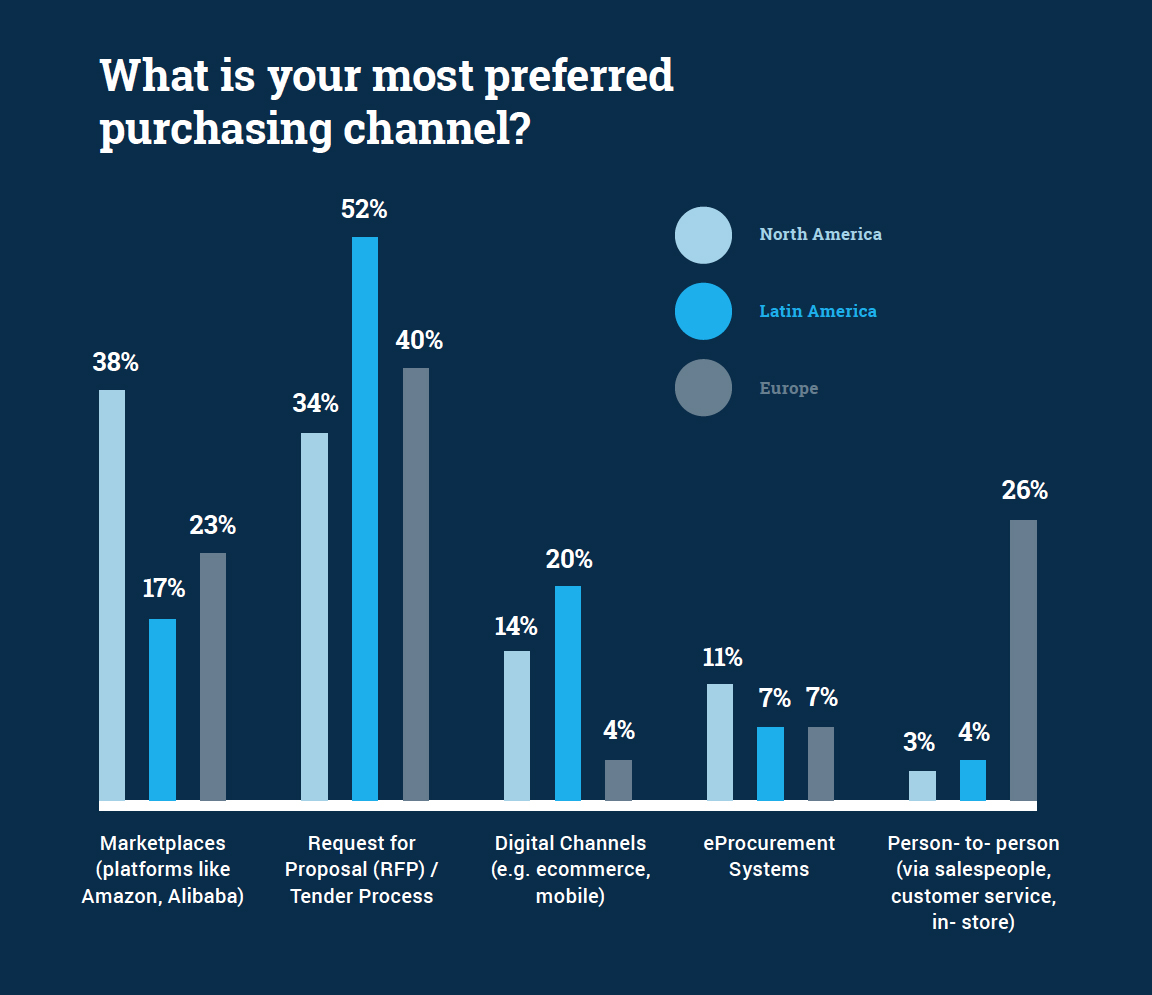

We can further consider the growing gap in the context of buyer preferences. Respondents were asked to select their one most-preferred channel. Researchers analyzed the results across all respondents, and then broke down results into both age group and regions of operation.

Forty-one percent of all respondents prefer the RFP or tender process, above all others. About one-quarter of respondents prefer marketplaces—now a substantial role in digital B2B buying—and 11% prefer other digital channels, including ecommerce and mobile.

Only 14% of respondents continue to prefer person-to-person sales, including salespeople, customer service, or in-store interactions. Only eleven percent prefer other digital channels (e.g. ecommerce, mobile), and only 8% prefer eProcurement systems.

Flash Finding

Over one-quarter of B2B buyers (26%) identify marketplaces as their most preferred purchasing channel, and more respondents (87%)—including 97% of Millennials—buy through marketplaces in general than in any other channel.

Purchasing Channel Preference by Age Group

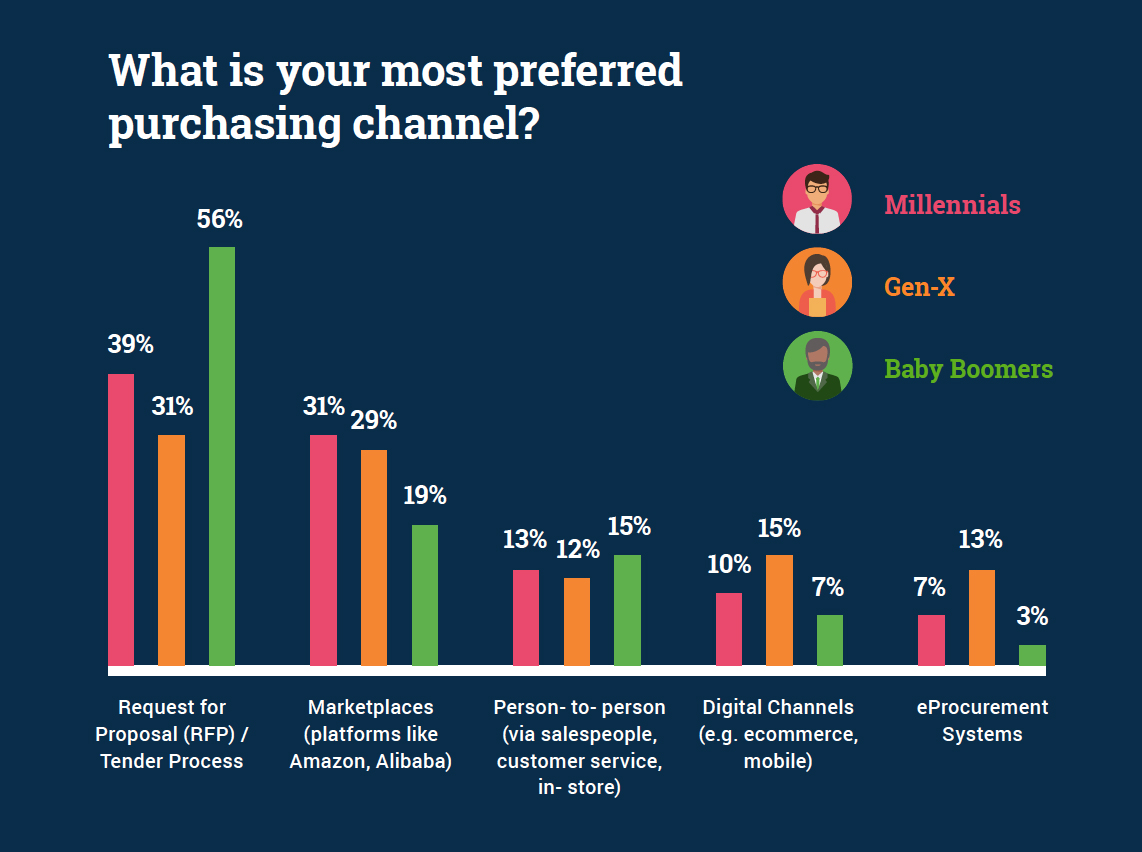

In a broad way, age groups are uniform in their channel preferences. However, notable differences show signs of an evolutionary shift towards marketplaces and digital channels. As Baby Boomers continue to prefer the RFP or tender process and discourage all digital channels more than other generations, Millennials favor both marketplaces and digital channels more than the other two age groups in the study. We will find that all age groups prioritize digital channels, each for different reasons.

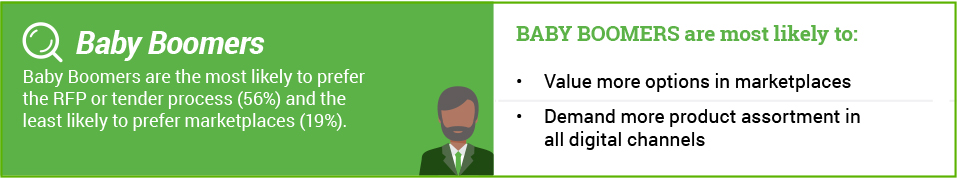

Researchers found that most Baby Boomers (56%) prefer the RFP or tender process—the

greatest majority to prefer this channel among age groups, based on the age group ratios in the study. Boomers are 17% more likely than Millennials to prefer this channel and 25% more likely than Gen-X.

Millennials (31%) are most likely to prefer marketplaces, whereas Boomers (19%) are the least likely. Specifically, Millennials are 12% more likely to prefer marketplaces than Boomers. Gen-X prefers the RFP or tender process (31%) and marketplaces (29%) almost equally. Gen-X is more likely to prefer digital channels (15%) and eProcurement systems (13%) than other age groups.

Researchers considered regional differences in their analysis of evolving buyer preferences.

The results show that each region favors specific purchasing channels as well, in some cases much more than others.

At 38%, buyers from companies that operate in North America are more likely to prefer marketplaces than any

other purchasing channel. They are 15% more likely than those in Europe and 20% more likely than those in Latin America to prefer marketplaces as well.

At 26%, buyers from companies that operate in Europe are far more likely to prefer person-to-person channels than those in Latin America (4%) or North America (3%). Latin American buyers are the most likely to prefer digital channels (20%) and the RFP or tender process (52%).

Recognizing Buyer Experience Needs in Digital Purchasing Channels

73% of buyers generally use digital channels.

However only 11% claim digital is their preferred method to buy, indicating there is a demand for better digital experiences. In our study, respondents expressed their next-gen B2B experience needs:

“B2B transactions are missing the digital boost.”

“We’re in the construction business, and we’re very much interested in emerging technologies such as virtual reality for better product viewing... We need the required equipment and tools in order to have a clear understanding of the project, and [virtual reality] makes it easier to make purchasing decisions that keep [our] business risk free.”

“There is a need to innovate with new concepts and services in order to make the customers satisfied.”

“There is a need [for] more innovative technology to be present in order to speed up things and also have accuracy in operations.”

“It’s high time digitization is prioritized in these transactions.”

“We have a high number of transactions that are carried out on a daily basis... with modern developments, we have to open our business to alternative payment methods.”

“Payment methods are most important when it comes to better purchasing decisions, because the market is vast and diverse with different currencies; and when it comes to exchanging capital for services or products, it does pose a challenge at times because of the currency fluctuations.”

“Machine learning will be able to manage our purchases efficiently. [It] will be able to keep track of operations and stocks and make necessary recommendations on the next purchase order.”

“A very good search engine to make sure we can find the right solutions and the right products.”

“The virtual reality space has been undermined after augmented reality was launched. But virtual reality has more to offer for businesses like us who need to deal with bigger purchase decisions...made based on one product that is shown to us. We have to spend more to view this product, but this will reduce with the efficiency of virtual reality.”

“Mobile apps are playing a major role in business operations because it makes everything quite handy when it comes to purchasing products and services.”

“For our product list, augmented reality is the best emerging technology right now. [Now] we have all seen how furniture could be measured [then] virtually placed to see how it would look... Our purchasing decisions will be based on the same experience, too.”

Age Groups Prioritize Needs and Digital Benefits

Despite their growing adoption, digital channels are yet to support some of buyers’ unique demands and expectations carried over from traditional sales environments. They recognize scenarios in which digital channels do not support certain types of sales. Most respondents see issues with sales of products that have inherent barriers—those that wouldn’t be transferable through digital channels in any case.

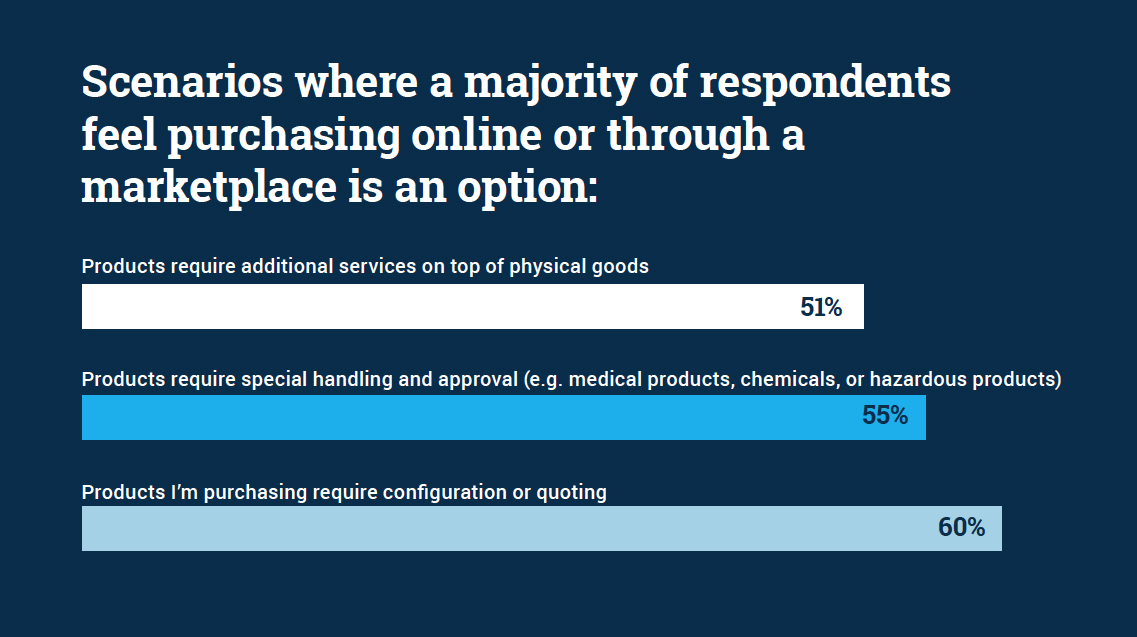

A majority of respondents believes the following scenarios are possible when purchasing online or through a marketplace: products requiring additional services on top of physical goods (51%); products requiring special handling and approval, such as medical products, chemicals, or hazardous products (55%); or products requiring configuration or quoting (60%).

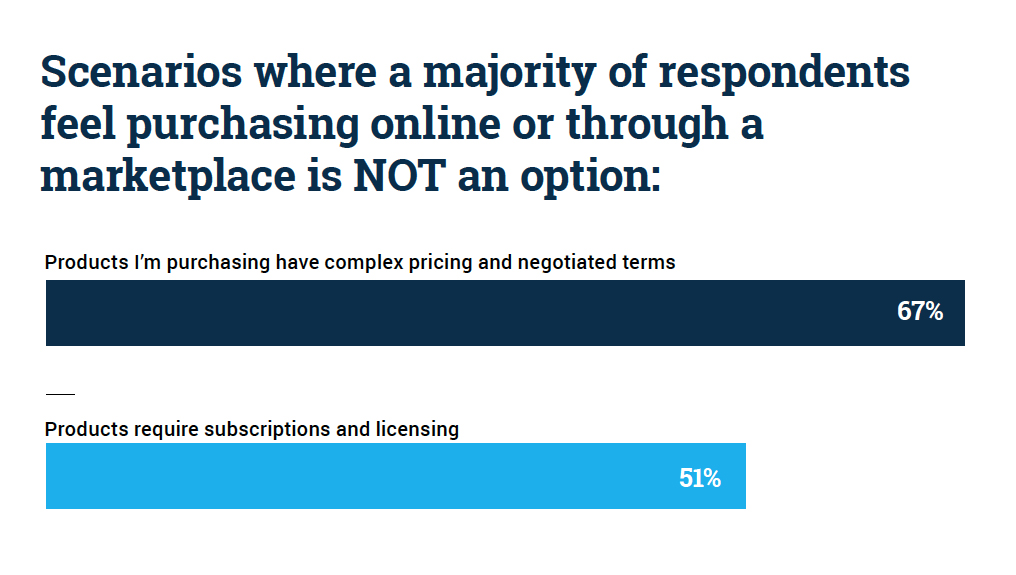

Most respondents believe only inherent barriers like complex pricing and negotiated terms (67%) and subscription and licensing requirements (51%) eliminate digital buying channels as options—requirements that may be difficult for these channels to facilitate.

These weaknesses bring to mind the aforementioned gap between general and preferred purchasing, and that between existing and evolving needs for purchasing. Even as most respondents generally buy through digital channels, not all of them can be preferred channels if they don’t support all of the products buyers need.

Buyers bring expectations and priorities within the context of marketplaces and digital channels as well. As we will find, each age group prioritizes and values those capabilities most aligned with their existing preferences and pain points.

Buyer empowerment is perhaps the greatest benefit marketplaces and digital channels bring to customers. Customers can rate vendors and products, select from a wide range of options, and personalize engagements to improve their performance. But that ‘empowerment’ means something different to each type of buyer.

“The majority of the customer base comprises [young and] middle-aged people who have technology all around them and can comfortably manage their operations with the use of smart phones [and] mobile apps... Amazon is advancing with the necessary innovations required.”

Cindy Tsang, Vice President, Global Sourcing & Procurement at Four Seasons Hotels and Resorts

B2B Digital Purchasing Channel Summary By Age Group

The following is a breakdown of what elements each age group prioritizes, values, and demands within all digital environments. Each age group is represented as follows:

*See Appendix B for the complete data.

Summary

Among age groups, Millennials prioritize the most benefits found in marketplaces and all digital environments. They also stand in stark contrast to Gen-X in terms of the types of benefits they prioritize. While Millennials expect transparency, flexibility, personalization, and more service options, Gen-X most prioritizes convenience: fast shipping, better customer service, and tools that help.

They find the right products for their company with the least amount of effort or friction.

Baby Boomers differ from the two younger age groups in that they prioritize most benefits to a lesser degree. However, they are most likely to enjoy greater options and a wider assortment of products than the other two age groups.

Conclusion

Each generation may differ in terms of how digital channels appeal to them, but they all exemplify how these evolving models can succeed with both buyers and sellers. Although digital continues to run alongside traditional buying practices, both ends of the sales funnel identify advantages that are not only ‘nice to have,’ but reflective of real concerns and changes in the market.

The future will inevitably hold more technological breakthroughs that change the way B2B sales operate. Buyers and sellers must approach new technologies and channels with caution, ensuring they will successfully fulfill real-market needs. But as we’ve observed in recent trends, digital channels will find a key role from all angles of analysis— evolutionary, generational, and transitional from traditional buying.

Works Cited

- Forrester Data: World Online Population Forecast, 2017 To 2022 (Global). March 22, 2017.

https://www.forrester.com/report/Forrester+Data+World+Online+Population+Forecast+2017+To+2022+Global/-/E-RES137509

About the Authors

Mirakl gives companies a fast path to increase customer value by launching an online marketplace. Marketplaces exceed customer expectations by providing broader selection, at better prices, with superior service while respecting your Brand DNA. The Mirakl Marketplace Platform is a turn-key SaaS solution that automates the hard things: Seller onboarding, product data management, service quality control, and order distribution; on an API-based solution that’s modular and easy to integrate into any e-commerce platform. Over 150 customers operating marketplaces in 40 countries trust Mirakl’s proven expertise and technology including Urban Outfitters, Hewlett Packard Enterprise, Best Buy Canada, Carrefour, and Walmart Mexico. For more information: www.mirakl.com

Oracle Commerce Cloud is a fully featured, extensible SaaS commerce solution, delivered in the Oracle Cloud, supporting B2C and B2B models in a single platform. Oracle Commerce Cloud grants greater agility and cost savings, with the extensibility and control required in the ultra-competitive digital commerce market. Find out why leading brands leverage Oracle Commerce Cloud: cloud.oracle.com/commerce-cloud

B2B Online is the premiere, annual, interactive event for digital and eCommerce executives within the industry. B2B Online will give you the tools to address key issues you face including, the multigenerational workforce, digital marketplaces, globalization and localization, tracking ROI on eCommerce investments, customer experience, omnichannel integration, content management, and mobile and social.

We are a team of writers, researchers, and marketers who are passionate about creating exceptional custom content. WBR Insights connects solution providers to their targeted communities through custom research reports, engaged webinars, and other marketing solutions. To learn more, visit us at www.wbrinsights.com